How Much Can I Contribute To A 401k In 2024. Advantages of 401 (k) accounts: For 2024, the limit for 401(k) plan contributions is $23,000, up from $22,500 last year, according to the irs.

The contribution limit for 401 (k)s, 403 (b)s, most 457 plans and the federal government’s thrift savings plan is $23,000 for 2024, up from $22,500 in 2023. For 2024, the 401(k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

The Maximum Contribution Limit For Roth And Traditional Iras For 2024 Is:

In 2023, the limits were $66,000, or $73,500 for people 50 and older.

That Limit Also Applies To 457, 403(B) And The Federal Government’s.

This year the irs announced there will be an increase to the maximum employee 401 (k) contribution limit for 2024,.

Employees Can Invest More Money Into 401(K) Plans In 2024, With Contribution Limits Increasing From 2023’S $22,500 To $23,000 For 2024.

Images References :

Source: hoagsomematim.blogspot.com

Source: hoagsomematim.blogspot.com

at what age do you have to take minimum distribution from a 401k Hoag, Employees can contribute up to $23,000 to their 401(k) plan for 2024 vs. If you are 50 or.

Source: clementinewbrynn.pages.dev

Source: clementinewbrynn.pages.dev

2024 Charitable Contribution Limits Irs Linea Petunia, For 2024, you can make a contribution of $46,000, which is an increase of $2,500 from 2023, no matter your age. If you’re 50 or older, you can stash an additional $7,500 in your 401(k).

Source: sheetsforinvestors.com

Source: sheetsforinvestors.com

Free 401(k) Calculator Google Sheets and Excel Template, This adjustment provides individuals with an opportunity to save more for. 401(k) contribution limits for 2024.

Source: onidaqiolanthe.pages.dev

Source: onidaqiolanthe.pages.dev

Simple Irs Contribution Limits 2024 Dore Nancey, What are the new solo 401k contribution limits for 2024? Those age 50 or older can contribute $30,500 to traditional and roth accounts, or $19,500.

Source: zarlaqfanechka.pages.dev

Source: zarlaqfanechka.pages.dev

Last Day To Contribute To 2024 Roth Bill Marjie, These limits increase to $69,000 and $76,500, respectively, in 2024. The standard deduction for 2024 is $14,600 for individuals or $29,200 for married couples filing jointly.

Source: iravs401k.com

Source: iravs401k.com

Can I contribute 100 of my 2022 salary to my 401k? IRA vs 401k, This adjustment provides individuals with an opportunity to save more for. Those 50 and older will be able to.

Source: iravs401k.com

Source: iravs401k.com

How much can I contribute to my Roth 401k? IRA vs 401k, People 50 and over can contribute. Savers will be able to contribute as much as $23,000 in 2024 to a 401 (k), up from $22,500 in 2023, an increase of $500 from 2023.

Source: www.tffn.net

Source: www.tffn.net

How Much Can You Contribute to a Roth 401k? Strategies for Maximizing, For 2024, you can contribute up to $69,000, or $76,500 if you're 50 or older. Those age 50 or older can contribute $30,500 to traditional and roth accounts, or $19,500.

Source: iravs401k.com

Source: iravs401k.com

How much can I contribute to my 401k and IRA in 2022? IRA vs 401k, In 2024, you can contribute up to $23,000, plus a. Contribution limits for a roth 401(k) are the same as a traditional 401(k).

Source: neelishroman.blogspot.com

Source: neelishroman.blogspot.com

Ira growth calculator NeelishRoman, The standard deduction for 2024 is $14,600 for individuals or $29,200 for married couples filing jointly. Those 50 and older will be able to.

Employees Can Contribute Up To $23,000 To Their 401(K) Plan For 2024 Vs.

For 2023, the limits were $66,000, or $73,500 if you're 50 or older.

Those 50 And Older Will Be Able To.

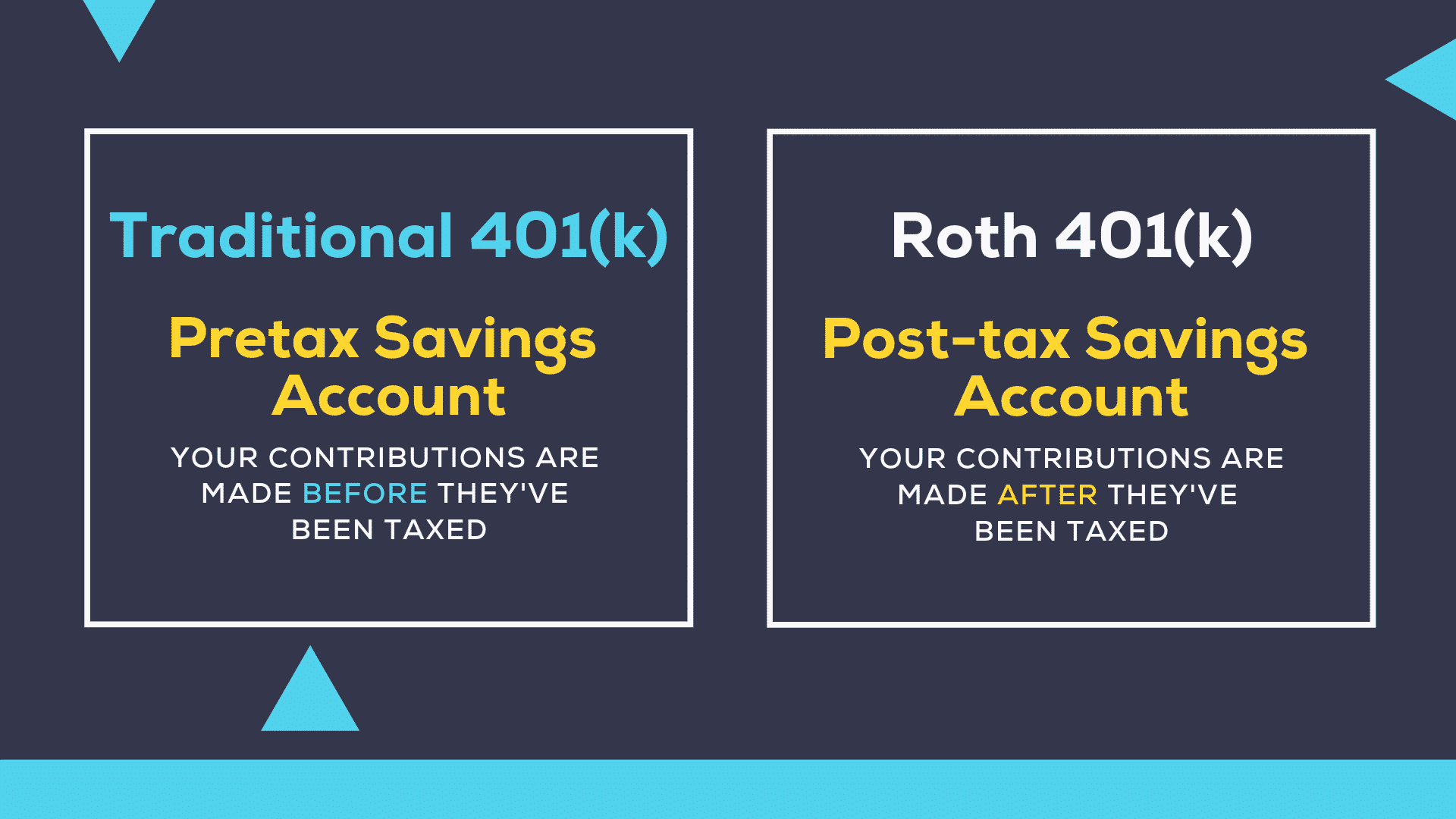

Contribution limits for a roth 401(k) are the same as a traditional 401(k).